The Wheel Strategy Explained (Using RVNC Stock)

The Wheel Strategy Explained (Using RVNC Stock)

RVNC is currently around $3 a share. It is undervalued considering its market presence and potential in the Botox market field. Here's how we'll use the wheel strategy with it:

RVNC is currently around $3 a share. It is undervalued considering its market presence and potential in the Botox market field. Here's how we'll use the wheel strategy with it:

You can buy some shares (at least 100) or keep selling cash-covered puts, hoping they won't be assigned. In this case, because RVNC is undervalued, you'd be happy to purchase it, making it a win-win situation if you find stocks like this.

I usually avoid buying shares directly and prefer to sell cash-covered puts to average down or keep collecting premiums. But the difference between price now and the put strike is too much to have much value in premium. I usually do both. buy shares and sell cash covered puts. but Buying shares is easy, so you can do that, but here's how to sell cash-covered puts:

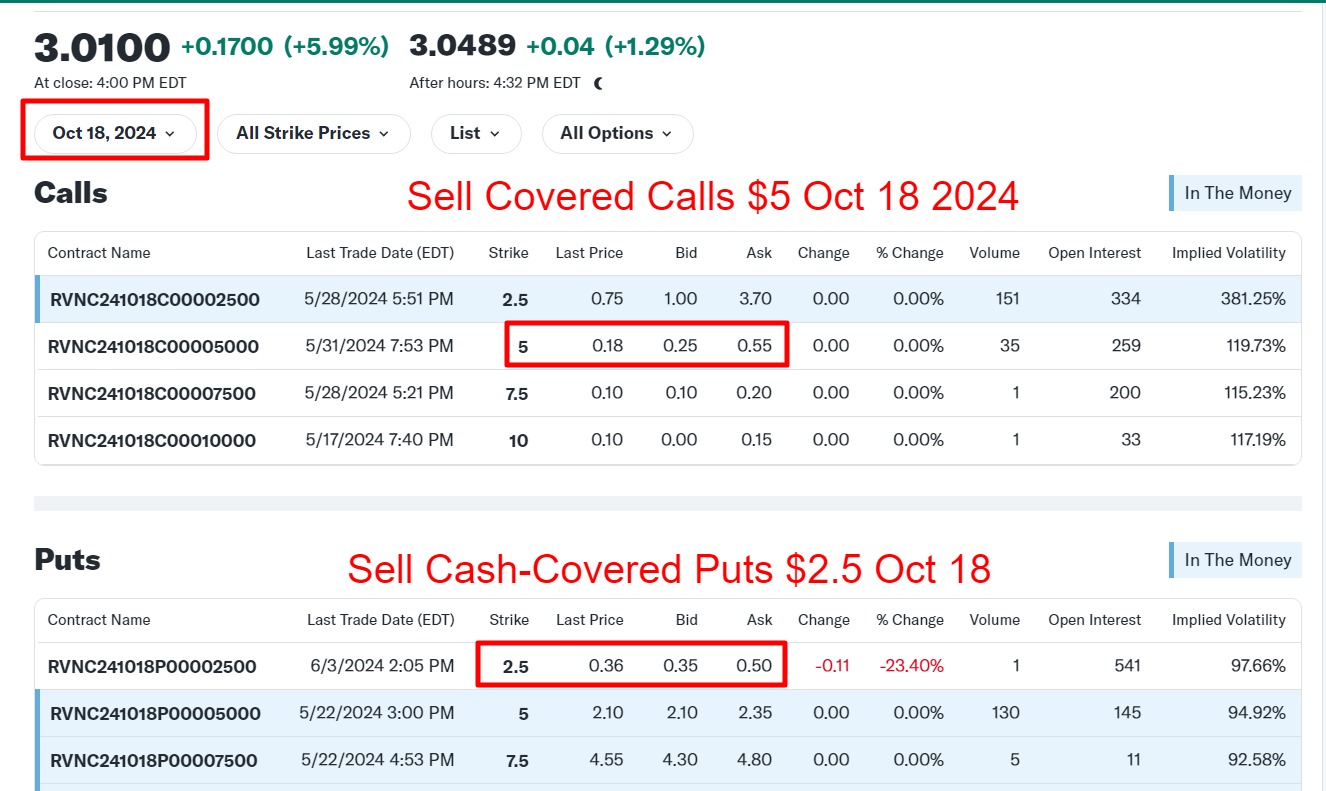

Sell Cash-Covered Puts: Start by selling a put option on RVNC with a strike price of $2.50, currently priced around $0.40. Since RVNC is $3 a share, and options contracts are for 100 shares, you need $250 to cover it. You get a premium of $40 for selling the put. If RVNC stays above $2.50, the option expires, and you keep the premium. If it drops below, you buy the stock at $2.50 per share. Cash-covered puts make more sense if the price is closer to the put strike price. In this case, there is a 50 cent difference, so you won't collect much premium. It's better to buy shares, and if the price goes below $3, keep selling cash-covered puts at $2.50.

Buy the Stock: If the put option is exercised, you'll own 100 shares of RVNC at $2.50 each.

Now, let's say you have 1000 shares of RVNC. You can sell 10 contracts at strike $5 for October 2024 expiry. So, you not only make money with shares ($3 and $2.50 cost basis), but you also collect the premium. You make more than 50%. Even if you don't, it's fine—you keep selling calls until your shares become virtually free.

Here's how to sell covered calls:

Sell Covered Calls: Now that you own the stock, sell a call option on RVNC with a strike price of $5, currently priced around $0.60, for October 2024. You get a premium of $60. If RVNC stays below $5, you keep the stock and the premium. If it goes above, you sell the stock at a profit and collect the premium.

Repeat: Keep repeating the process to generate consistent income.

Why Use the Wheel Strategy?

Generate income from option premiums.

Potential for stock appreciation. The stock is likely to move higher in the next year or so.

With $300 to start, this strategy can help you steadily build your portfolio and generate income. Let’s get started with RVNC! Keep this in your portfolio to realize the potential of steady income.